The Use Cases, Limitations and Potential of ENS Subdomains

TL;DR:

- Web3 subdomain names like ENS’s have a variety of use cases, chief among which is enabling users to show they are affiliated with a company or a community.

- There is already plenty of adoption and we investigated basically all of the projects that have started using subdomains in some form or another.

- There are some current limitations but these are currently being addressed with new projects in the space by a variety of players in the ecosystem.

What’s in a Name?

My ENS name is olesnakey.eth. It’s derived from my handle, OleSnakey, that I use for games, Discord, Twitter, and pretty much everything else in web2 since I was in 5th grade. It’s named after an old Gmail feature called “Old Snakey” where you can press Shift+7 in your inbox to play a simple game of Snake, which I often did when I didn’t feel like doing anything else. It’s not a good name by any measure. It’s goofy, long, sometimes tricky to pronounce/spell, and some people absolutely despise snakes for whatever reason. That said, I’ve used it for so long that it’s basically become a part of me, and that’s why I’m proud to use it for web3.

There is something special about names that differentiates ENS and other name service collections from other NFTs that are traded. Sure, some people may see using rare ENS names as just a financial flex but they forget that these domain names are fundamentally, well, names. And a name, whether they are a given name, nickname or gamer handle, is just a piece of language that identifies some individual. It also has the potential to communicate so much about that individual’s history, values, personality or affiliations. After all, it’s a safe (but not sure) bet someone has some Japanese ancestry if their last name is “Watanabe”. As we see with PFP based communities, this “affiliation utility” is a native property that NFT ownership can provide, but as we will explore in the report, ENS has an sometimes overlooked feature, subdomains, that can excel at this.

What are ENS Subdomains?

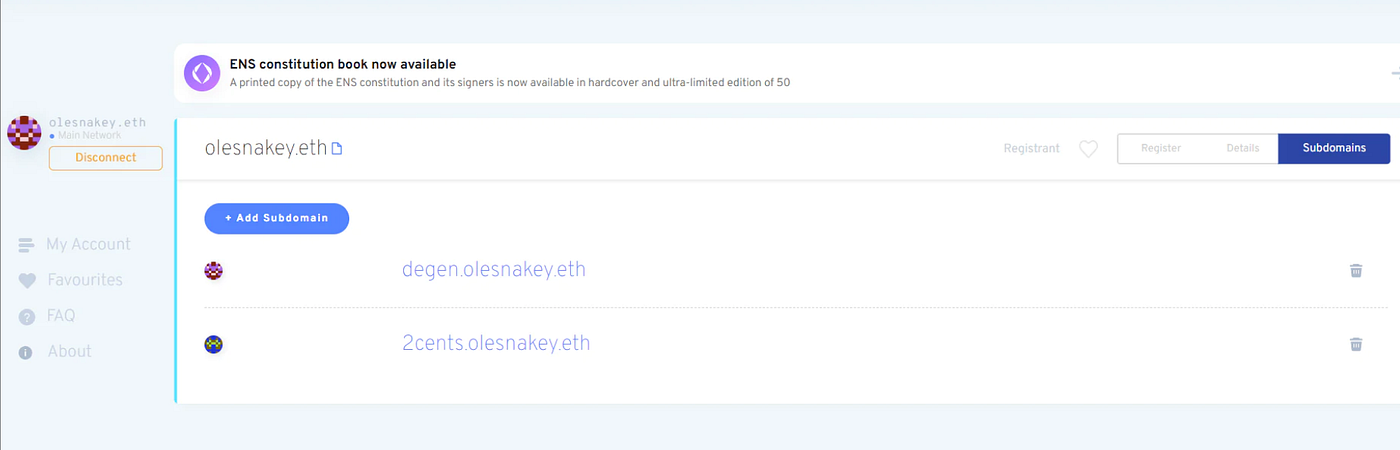

Once someone has created or obtained a second level ENS domain name(take for instance, olesnakey.eth), they have the ability to create as many subdomains under it as they wish (like 2cents.olesnakey.eth ), paying only gas for the transaction. Then they are free to assign them to whoever wants to use them to point them to ETH addresses. However, as of now, the controller also has the right to revoke access to these subdomain names, if they so choose.

As we will get into in this article, there are a variety of interesting use cases for this, some more intuitive than others. This feature might seem gimmicky and inconsequential to some at first, but here at Double, we see the adoption of subdomains as a potential major defining trend for ENS and other web3 name services as a whole, so we were compelled to research this topic extensively. Through that research, we have produced this report, we will look at the adoption of, use cases, current limitations, on-going development, and future potential of ENS subdomains.

By the Numbers: A Snapshot of the Adoption of ENS and it’s Subdomains

ENS Names

By every metric, ENS names are a top NFT collection. At the time of writing, on OpenSea, it is closing in on half a million owners and almost 50K ETH in total volume. Of course, it is still not without its competitors. Unstoppable Domains boasts a web3 name service without any renewal fees and there are also plenty of other ecosystem specific name services like Avvy’s .avax names for Avalanche and Bonfida’s Solana Name Service.

ENS Subdomains

As of the time of writing this article, there are currently roughly 1.9 million second level domains created. However, by comparison, there are only about 155K subdomains registered under second level domains. These all originate from 13K second level domains.

At the time we looked, there were only 69 domain names that have more than 50 subdomains under them. It’s these that we are interested in because many of these subdomains represent projects that are early adopters of subdomains.

Who is Using Subdomain Names Now?

We investigated the projects behind the domain names with 50+ subdomains and group similar ones into categories.

Here is our full list of projects that we investigated.

Our Categories:

1. Wallet and Infrastructure Projects

Example: Argent (argent.xyz)

Crypto wallets recognize that having their users copying and pasting public addresses when they want to make transactions is…not very user friendly because of the hassle and room for error. Because it’s reasonably cheap to provide their users with subdomains (just pay gas!), many of them do, from automatically creating one for the user upon registration to having it be a feature of the wallet.

2. Project Community / Organization

Example: Decentraland(dcl.eth)

Subdomains are useful for metaverse projects, holder communities and games because they can provide a sense of identity and affiliation. olesnakey.eth might be Jesse but olesnakey.dcl.eth would express how Jesse is affiliated with Decentraland. For games and metaverses, these names can also double as gamer tags or handles that show you play a certain game, just like they do for gamers like me in web2. For organizations, if access to these subdomain names is properly controlled, they can also be a source of verification. For example, BDs for projects can show they are legitimately affiliated with the project with a subdomain name issued by the organization they work for.

3. On-Chain Tools

Example: Chainlink (data.eth)

For developers, subdomains can be used to create API’s that point to contracts that provide information or services. This is superior to public addresses because it’s more convenient for the dev using the product and the service can freely upgrade to a new contract without forcing the people using the service to update as well, since you can just point the subdomain to the new contract.

4. Wordplay

Example: asksfor.eth

There are a lot of creative names that read like sentences you can make with ENS subdomains. For example, jesse.asksfor.eth (plz sir, may I have some moar?). Names in this category can form sentences in this nifty fashion but they don’t have to, they could just look nice, like dev.eth, if you are a developer.

5. Subdomain Registrars

Example: EthSimple (ethsimple.eth)

This category also includes names that are held in Domain Registrar type projects like ENSnow or EthSimple, where the name is held by a contract and anyone can use the service to mint their own subdomain on it for much cheaper than it would cost to register their own second-level domain. It’s also worth noting that there is a lot of overlap between these and the Wordplay category, because many of them will buy up these names and have them listed on the platform so anyone can claim them.

6. Other

Example: Crypto Stamp (cryptostamp.eth)

Not all projects that make use of subdomains fit in those five neat categories so this category is the catch-all for the rest of the pile. There are some unique projects and experiments in here like eth2phone (eth2phone.eth), and also some that we just couldn’t find any information about or figure out exactly how they use their subdomains.

Notable Projects:

1. Argent Wallet (argent.xyz)

Argent.xyz is the project with the highest number of registered subdomains. Like we’ve already covered, subdomain names are especially useful for wallets but argent takes it one step further by adding additional utility. XXX.argent.xyz is actually a valid URL, and argent takes advantage of this by having the subdomain also link to the Argent profile page in web2 along with being the address to the wallet, which has a number of UX benefits.

2. Decentraland (dcl.eth)

Decentraland names showcase the potential of subdomain names to function as domain names once they are made tradable and users are able to register them by themselves. The DCL dev team made it possible, for the price of 100 MANA, to mint their own name on the DCL second level domain. These have become a hotly traded collection in their own right, with a total volume of nearly 1000 ETH on OpenSea. These names also scratch the surface of what you can do with subdomain names in metaverse projects such as using them as teleport addresses to locations or avatars.

3. Mirror.xyz (mirror.xyz)

As the web3 take on platforms such as Medium, Mirror is unique because unlike many other projects on the list, its subdomains are not designed to be publicly available or easily obtainable through purchase. The subdomains can only be acquired with a $WRITE token which is bestowed by a DAO vote after a weekly writing competition. This subdomain is used to recognize someone as a member of the mirror DAO and gain corresponding privileges and responsibilities such as voting. Mirror showcases how the scarcity of names can be engineered rather than naturally forming. After all, unlike the 000.eth-999.eth 1K club, There is no mathematical limit to how many subdomains mirror.xyz has, but there is a practical scarcity of how many people can join the DAO, and so these subdomains can be just as valuable as status symbols.

4. Purrnelopes Country Club (pcc.xyz)

PCC’s subdomain offering is a prime example in how they can provide utility to holder communities. Since these communities are essentially the web3 equivalent of sports teams, you need ways to express your affinity: the new forms of T-shirts, keychains and merch. Using subdomains as your wallet/Twitter name is just that.

Utility of Subdomains, Generalized

1. All the properties of ENS second level domains (Wallet Routing, Status)

Everything that is valuable about second level domain names can be valuable for subdomain names. Yes, it’s worth remembering they still can replace an inscrutable ETH address with a human readable one in crypto transactions. But it’s also worth pointing out that rare ENS names have the NFT property of scarcity and status. Rare and impressive ENS names are collected and traded just like any other NFT and once subdomains are more widely adopted, why would they be any different? Imagine if BAYC launches a campaign where whitelisted holders can mint their own subdomain name on ape.eth. If those were tradable, what would be the market value for those names?

2. Affiliation

Subdomains can also provide the NFT utility of showing that you are affiliated with a group, project, game or organization. Arguably, they can do this even better than second level domains. Getting tribal tattoos, Decorating with national flags and holding certain NFTs all serve the function of signaling that you belong in a certain in-group and second level domains excel at this because they show that you are a part of a group in a very explicit fashion. This group can be any group of people: organizations, sports team fans or even families. These communities also gain the ability to whitelist users more effectively or even confer privileges based on the addresses the subdomains point to. They will even be able to white list who can register a subdomain based on conditions like whether an address is a NFT holder or not.

3. Linking

Sure, all ENS subdomains can link to eth addresses, but there is no reason for that to stop there. As we see with argent.xyz, some are capable of linking to web2 addresses as well. However, in metaverses/games like Decentraland, they can not only serve as the handle, but they also have the potential to be configured to point to certain locations, locations of avatars in the world or programmed to do literally anything else in the ecosystem or game.

4. Just plain cheaper!

Depending on the price of Ethereum and gas, registering a ENS second level domain can be prohibitively expensive for some. Second-Level domains, on the other hand, are significantly cheaper, with a cost dependent only on gas. Because these subdomains are so much cheaper than second level names, the mass adoption of subdomains can be a driver of the mass adoption of ENS, Ethereum and web3 as a whole.

Current Limitations

1. Gas Intensive

It’s worth noting that, each time a subdomain is created, it’s an on-chain transaction that costs gas. This is usually negligible but for some of the use cases, there could be thousands of users and community members registering subdomains, so, depending on the gas price, the costs can add up for either users or the project.

2. Revocable

In the way ENS subdomains are set up now by default, they are not technically owned by their users as property. At any point, the owner of the second level domain can revoke access to it. While this may be a benefit for some projects who wish to maintain maximum control of their subdomain names, many users are not comfortable with this. After all, why would you pay for something that can just be taken away?

3. Not Tradable By Default

As of now, if a project wants their subdomains tradable, they have to do custom coding, like the Decentraland team did for the dcl.eth subdomains. Many projects want their subdomains tradable, but not all can spare the development time, which makes ENS subdomains underutilized.

4. Custom Coding Needed for Self Service

One is able to manually create and delegate subdomains through the ENS User Interface but as of now, there is no standard way for users of a project to register subdomains by themselves, it must be custom built by the project, like Decentraland and PCC. If projects wish to adopt subdomains for their users, this, again presents the additional cost in the form of developer time.

Upcoming Development

1. ENS Namewrapper

ENS’s upcoming Name Wrapper feature will make subdomains more like second level domains — as tradable NFTs. Wrapped names are ERC-1155 compatible and with a new feature called fuses, permissions to to control usage and ownership rights, like being able to transfer and make sub-sub-domains can be better customized and controlled. As ERC-1155 tokens, main domains and subdomains will also become tradable as well in the same collection.

2. Coinbase’s cb.id Subdomain System

Coinbase is working on a layer 2 domain name system for its users built on top of ENS. Once it’s launched, because the company has roughly 98 million users, it may become the largest adopter of subdomains. The logic is the same as it is for all wallets/infrastructure projects we’ve already examined: give users human readable subdomains because it enhances the user experience by making it more convenient to send funds.

3. Double’s Subdomain Subscription (Shameless Shilling Alert!)

We’ve recently launched our own subdomain product: Double’s Subdomains-as-a-Service, which enables projects to give subdomains to their users in a few clicks. All the ENS holder has to do is stake the ENS second level domain name on the contract, then select whether anyone can register a subdomain on it or just limit it to a whitelist. They will even be able to earn royalties from the number of subdomains registered and renewed.

What can you do with subdomains? (By Context)

Web3 Communities

Members of web3 communities generally show affiliation by owning NFTs in the same collection and using it as their profile pictures. Using subdomain names of the same second level domain can also be a way to express affiliation. Access to these domain names entirely depends on the identity of the community: exclusive ones would be inclined to use a whitelist for their names, while more open ones would likely seek to allow anyone to be able to register a subdomain name.

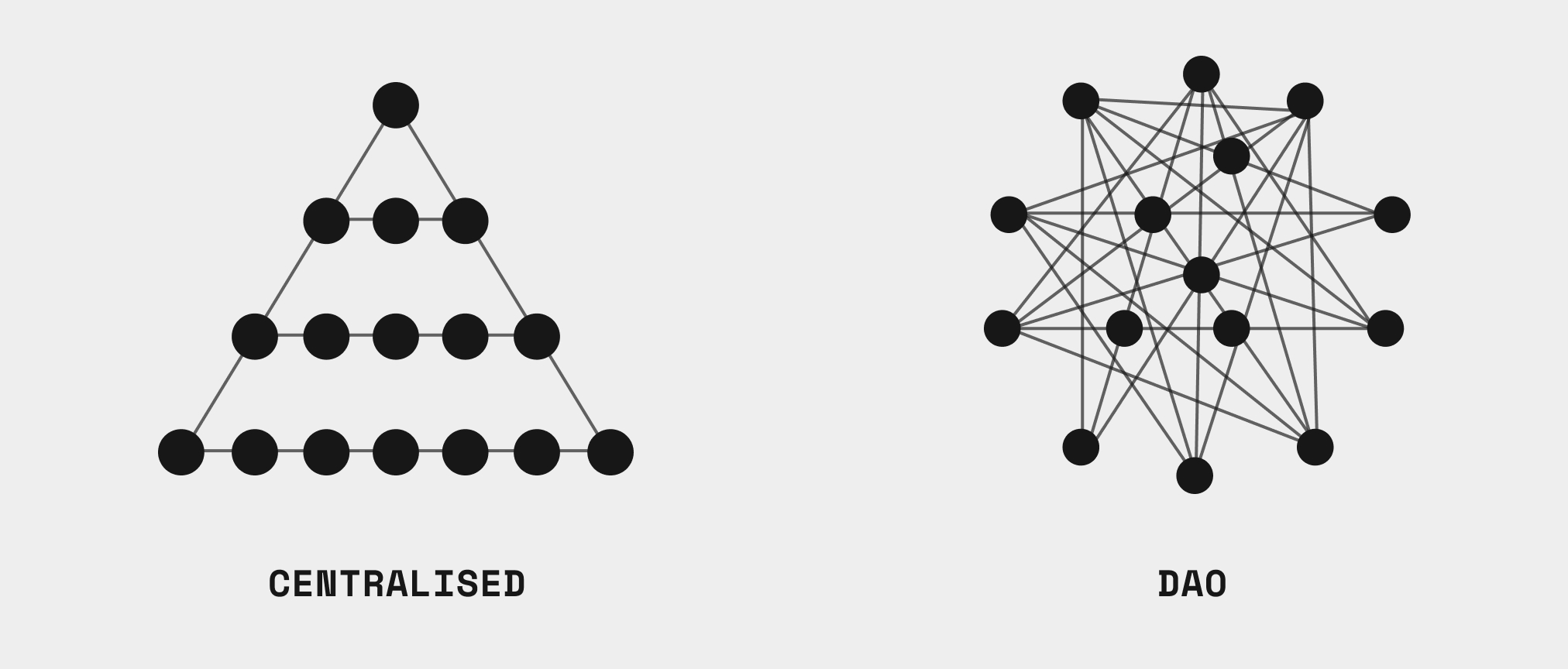

DAOs

One potential form of manipulation that DAOs have to be aware of is the possibility of someone taking out a massive loan of the token being used for governance ahead of the snapshot and leveraging it for voting. The use of subdomain names can be an alternative system for DAOs, as their acquisition can be better controlled with a whitelist (and presumably a vetting process for getting on it). It could also be argued that this is more democratic, as it’s no longer the opinion of the people with the most tokens with the most weight — rather, all with a subdomain would become equal when it comes to voting rights.

GameFi Guilds

In web2, guilds in MMOs are originally a source of affiliation within the game, leading to real personal relationships and vibrant communities. Web3 guilds have adopted the name of “guild” but they also have potential to provide that “affiliation utility” native to MMORPG guilds like say in, ahem, Guild Wars 2.

Metaverse / Gamer Name

GameFi games are also able to take advantage of the subdomains to have them represent the username of the players within the game. They are also able to implement additional features for the names within the game itself, such as enabling users to point them at different locations in the game. For example, say you want to teleport to a specific home in a metaverse platform, if the owner of the home has a second level domain name pointing to it, you could use that as the teleport address as well, and even send tokens to that address when making purchases!

Subscription Services

Because ENS domain and subdomain names are fundamentally subscriptions, they can be used to power other subscription products. As subdomains naturally expire if not renewed, ownership of the subdomain can potentially be used as an access token to a product or service.

Companies

Companies may wish to issue subdomain names to their employees. This is not only to foster a sense of affiliation that has been stressed to death in this report so far, it can also be a proof of legitimacy. How do you know if someone reaching out to you is actually Ryan, a business developer from OpenSea and not an impostor trying to scam you and your team? You could have him produce a signature with a wallet with ryan.opensea.eth.

Conclusion

As we’ve explored in this article, subdomains have so much potential value and use cases spanning almost the entirety of web3. Personally, sure, I’m happy with my janky olesnakey.eth as my main name in the Ethereum ecosystem but also I’m looking forward to picking up a few olesnakey.future-web3-game-im-obssessed-with.eth’s and olesnakey.this-shows-i-am-a-member-of-this-community.eth subdomain names as well.

Affiliation has been the glue that has built and holds together all of human society. Before there were discord channels built around NFT hodlers using their JPEG profile pictures, there were sports teams. Before there were sports teams, there were nation states. Before there were nation states, there were tribes. Before there were tribes, there were families. In web3 we are just seeing this force take a new form and subdomains are yet another way to express it.